Couplespeak™ Blog

Modupe Grace Ayobami is a passionate writer, relationship thinker, and storyteller who explores the intricacies of love, marriage, and human connection from a place of honesty and healing. She writes to challenge toxic norms, champion emotional intelligence, and inspire people to choose themselves boldly before choosing a partner. Her work is rooted in deep empathy, biblical insight, and a desire to see healthier relationships thrive across cultures.

This past month has been a whirlwind of initially trauma, then a series of sweet surprises and blessings. Following a serious car accident I've watched my body heal in unimaginable ways, consistent with the assurances of my doctors and nurses. I've learned about resilience, my own, but also other peoples'. My single sister came up to Maine to provide "nursemaid" services for two weeks, and graciously attended to me day and night. Her patience, diligence and compassion even surprised herself. My husband, who is limited physically, has done the same, also hauling my wheelchair in and out of the car, patiently fetching tons of thing I can't reach, and even walking Luca, our naughty dog, in the local park. This is all after "remodeling" our downstairs floor to be wheelchair-friendly, with all the supplies I need accessible - no easy feat! Our son and daughter-in-law have provided fabulous meals, visits, help with buying a new car, and new phones and watches so we can be more accessible. Our two granddaughters have visited and been loving, tender and attentive, surprisingly, at ages three and six! My other sister has provided funding for unlimited takeout meals, as her physical limitations prevent a late Winter visit up to Maine. Friends have provided dog walking, solicitous calls, and car trips to doctors while I'm unable to drive, with a broken right leg. Neighbors have provided the biggest surprises of all: multiple dog walks, pots of soup, ongoing offers of help, and continued concern about my status. I've been blown away by the compassion and generosity around me! These are people I would not previously have defined as "friends", but they sure will be, moving forward! Clients who previously insisted on live sessions, have been flexible and gracious in doing telehealth instead. One couple I've worked with for awhile sent me the largest, most beautiful bouquet of flowers I've ever seen in my life. I've also surprised myself with my resilience, mostly good cheer, adherence to the "Rules of Slow," and allowing others to help me, even asking for help when they can't read my mind. This has been virgin territory for me. So what's the lesson (besides trying to avoid avoidable car accidents)?: - Try not to shortchange either yourself or others with low expectations - see the possibilities. See the good in people. - Cultivate yourself as a Surpriser to others, particularly when they need it. Nurture community. Avoid self absorption. - Learn from adversity and grow. - Don't watch too much news, especially the traumatic stuff! It can distort your experience of life.... - Embrace the surprises that come your way, and let yourself feel deserving.

I have recently had a hard lesson on this subject after having a serious car accident last month. It was a cold day with icy roads and blinding sun as I drove East toward a local park to run Barley, our son's dog. Unfortunately, I dropped my sunglasses and foolishly did a quick dive for them, then ended up in a deep gulley on the side of the road, and hit a tree. The car was demolished, I ended up with 16 broken bones, but luckily, Barley was unscathed! Thankfully, his pre-existing dementia has probably protected him from remembering the event! Here I am, 3 weeks later, after two hospitalizations, fortunately with no permanent injuries, and no needed surgeries. Most importantly, no brain damage, so I'm my usual feisty, engaged and passionate self, able to do my work remotely. The unfortunate part that I've had to accept is being wheelchair - bound for at least 6 weeks, and dependent on my tired husband and sister to be nursemaids to me. Ugh! No usual 20 year old energy, doing this and that each day, running Luca, our dog in local parks when he's not in daycare. No stairs, so no upstairs showers or bedroom amenities like sleeping in a normal bed. No speed at anything now, as the smallest of actions need to be intentional and SLOW to prevent further injuries. (Having to accept and embrace SLOW has been totally foreign for me, like being a 90 year old)! I've had to accept routinely asking for help without shame or guilt, and graciously accept the ways people provide it. My friends, family and neighbors have been amazingly generous with their time, offering meals, dog walks, and various services. And each day I'm miraculously getting stronger with less pain, and more functionality! What I can tell you about Acceptance is that it's multi-pronged: It requires staying present and not going into regrets or "woulda-shoulda coulda''s" It requires the ability to count your blessings and lean into gratitude rather than focus on self pity - (It's amazing I survived this particular wreck! and have been the recipient of so much love and care). It requires the willingness to learn from experiences and see them as sometimes difficult, but valuable tools. It requires self compassion, and being gentle with yourself. It requires patience and perspective. "This too shall pass. Nothing is forever." It requires quieting the possible noise in your head, the toxic narratives you may spin about causality or fate. And for me, it really requires a sense of humor - without laughing too much because that doesn't jive well with broken ribs...... :) Susan

Here’s another piece by Cheryl Conklin about the joys and challenges facing senior couples, something very common in my work. Aging together gracefully requires intentionality around all these issues, in addition to being conscious and collaborative around parenting grown children and grandchildren. I recommend that couples build in check-ins regularly around all these tasks so […]

The post Navigate Marriage and Life-building in Your Golden Years: A Comprehensive Guide for Senior Couple appeared first on Susan Lager.

Here’s another very astute piece by Cheryl Conklin of https://wellnesscentral.info addressing an issue which comes up frequently in my work with individuals and couples – how to nourish love at the “halfway” point, how to keep love and pleasure alive long after the original glow has worn off. And, contrary to popular myth that it’s […]

The post Finding Each Other Again: Rediscover Love in Mid-Life appeared first on Susan Lager.

Here is an article by the very wise and articulate Cheryl Conklin of Wellness Central, about a subject central to my work as a therapist: stress – what causes it, and how to manage it on various fronts, so it doesn’t manage you. Stress is a normal part of everyday life, especially in today’s world […]

The post Stress Decoded: Personalized Strategies for a Calmer You appeared first on Susan Lager.

Hello Reader, Earlier this week I did a BlogTalk Radio podcast about being intentional in your marriage, and in all your close relationships. This episode was about how when we live on purpose everything can change – our pleasure and happiness levels, our experience of connection with a partner and close friends, expectations can be adjusted more realistically, […]

The post “The Amazing Impact of Being Intentional in Your Marriage” – don’t miss the podcast! appeared first on Susan Lager.

“Once again, Cheryl Conklin from WellnessCentral.info has hit the mark with her latest insights about how confidence can be enhanced through specific attitudes and behaviors. (I like to tell my clients that it’s a myth to think that confidence is a born trait, or that you only have it if you were on the right […]

The post Boost Your Confidence and Live Life on Your Terms With This Guide appeared first on Susan Lager.

CNN Health: “5 Signs Your Coronavirus Anxiety Has Turned Serious, Threatening Your Mental Health, and What to Do About It” Written by Susan Lager on May 12, 2020. Posted in Acceptance, Anxiety, Attitude, Balance, Change, Comfort, Connection, Courage, Depression, Gratitude, Grieving, Help, Humor, Life’s curveballs, Mindfulness, Perspective, Resilience, Resources, Rituals, Self care, Stress, Tools, Trauma […]

The post 5 Signs Your Coronavirus Anxiety Has Turned Serious, Threatening Your Mental Health, and What To Do About It appeared first on Susan Lager.

I was about to post about managing transitions when I saw this post from the Gottman Institute, realizing how relevant it was to my subject. I’m sharing it with you, hoping you benefit from all the wonderful ideas in it. Having fun and being intentional can be a vital part of dealing with transitions. Stay […]

The post Shifting Into Fall with Fun! appeared first on Susan Lager.

Image Courtesy of Pexels Here’s an excellent guest article by Cheryl Conklin from wellnesscentral.info about tools for self nurture and for avoiding negative thoughts and behaviors. These tools are important for everyday life, and even more critical during the pandemic. Stop. No, really, stop. Those harmful habits of yours are hurting you! Not sure which […]

The post Stop Right There: Unhealthy Habits to Kick for a Better Personal Life appeared first on Susan Lager.

Awhile ago, I worked with a couple who had this conversation in a session: “You know, sweetie, I decided that paying only $3500. for the bike I want would be a great deal! The electric bikes run about $5000 to $6000 average! We could finance it easily with your excellent credit, or just buy it […]

The post Who Controls the Money? appeared first on Susan Lager.

The number one complaint couples refer to when they call with a therapy request is “We don’t communicate.” Sound familiar? And oddly, unless partners are each bound and gagged (that’s another post, I think), or living separately in parts of the world without telephones, video or email, they communicate – maybe not clearly, or respectively, […]

The post The “We Don’t Communicate” Myth appeared first on Susan Lager.

This is one of the big issues most couples have struggled with at some point in their relationship: who pulled the trigger on a toxic event – who was really responsible for the mess? It usually goes something like this: “If you hadn’t said ______________________ I wouldn’t have been so ____________________!” “Well, if you hadn’t […]

The post Who Started The Fight? appeared first on Susan Lager.

I recently met with a couple I’ve been working with for quite some time. We hadn’t met in over a month due to a number of unforeseen events, including the fact that they’d each contracted Covid within the same week. It was a shock to them considering that they’d both been vaccinated and had practiced […]

The post Covid Silver Lining appeared first on Susan Lager.

There’s a word in Yiddish which has no literal translation in English: “kvetch.”It means “to complain, to moan, to bitch, to bellyache, to crab, grumble, fuss, nag, squawk, whine, gripe, etc. We all do it at times, but it can be a real problem when the kvetching hijacks your brain. It’s then likely to intrude […]

The post “Kvetch Dates” appeared first on Susan Lager.

It’s been a long, hard year locked up with ourselves amidst Covid 19. So many of our usual distractions and indulgences have gone by the wayside, and most of us have been starkly confined with our own neurotic shortcomings and lazy adaptations.Millions have gained the “Quarantine 15” and as things open up, are slightly agoraphobic, […]

The post You Gotta Laugh At it All! appeared first on Susan Lager.

In this 20 minute episode I discuss the process of losing traction and determination around commitments, why it happens, when it may be a positive thing, and when it may signal some personal or relational shortcomings.At the time of this writing we’re all hearing about thousands of people giving up their diligence about Covid safety […]

The post Tune into my next BlogTalk Radio podcast on Wednesday, 3/31 at 8:30 PM EST: “Giving Up – When It Helps and When It Hurts appeared first on Susan Lager.

“Here’s an article by Cheryl Conklin about good self care, generally, and especially during this pandemic.” Embrace Wellness Now for Better Confidence and Positivity It’s not uncommon to reach the end of the winter months feeling a little down. Lack of sunlight and long hours indoors can be hard on one’s well-being. Add to that […]

The post Embracing Wellness. appeared first on Susan Lager.

Covid 19 has presented some difficult issues for most people, and particularly for couples who can’t safely explore many options away from home for stimulation, excitement, fun and connection. Many couples seem to have run out of ideas for what to do amidst these various constraints. So, with her permission, I’ve republished Tamara Siegel’s article […]

The post 13 At-Home Date Night Activities to Stay Sane and Have Some Fun During Covid 19 appeared first on Susan Lager.

A client just forwarded this article by Sharie Stines, Psy.D to me. It was published on the PsychCentral site in July of 2016. It is excellent, and the points couldn’t have been stated any better, so I am reprinting it for anyone out there who has been struggling to stay afloat in a marriage to […]

The post “What To Expect When You Marry a Narcissist” by Sharie Stines, PsyD. appeared first on Susan Lager.

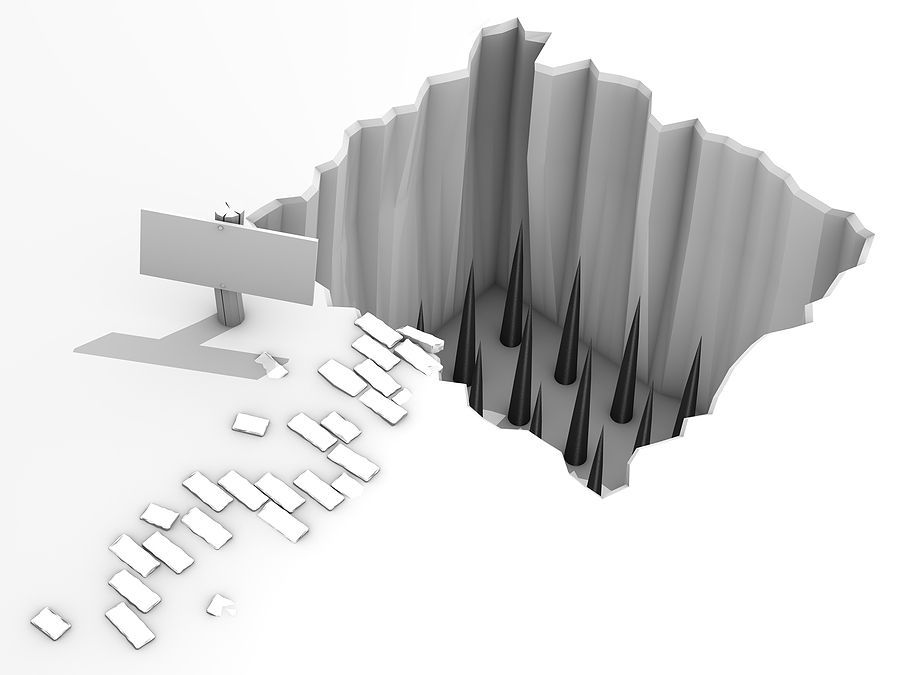

If your experience of 2020 and early 2021 feels like the above image, you’re not alone! No matter what side of the political fence you’ve embraced it has been a year of loss, constraints, hopelessness, helplessness, hatred, anxieties and extreme division, often among members of the same family, or among friends. Not only have most […]

The post Managing the Challenges of 2020 and the Uncertainty of 2021 appeared first on Susan Lager.

I read this CNN article and thought it was very timely and right on, I couldn’t have made this point any more clearly, so I’ve re-printed it.I hope you relate to it, and I’d say “Happy Thanksgiving!” but that kind of goes against the whole point here!Enjoy your meal, whatever company you can safely have, […]

The post Thanksgiving 2020 and Permission Not to Be So Thankful This Year appeared first on Susan Lager.

In a previous BlogTalkRadio podcast I delved into some strategies for living more fully amidst the Covid 19 pandemic. I discussed the physical and emotional challenges everyone faces, as well as the symptoms people were experiencing only a few months into the crisis.In this subsequent episode I’ll go deeper with my ideas for how to […]

The post Don’t miss my 10/29/20 BlogTalk Radio 25 minute podcast for more insights about staying afloat emotionally amidst the pandemic appeared first on Susan Lager.

Most people find it surreal that we’re living in a pandemic. Every day we hear the bleak statistics about where the diagnosed “positive” cases as well as the deaths are ramping up, especially as we face a Fall surge in contagion.Things we’ve previously taken for granted, like stress-free grocery shopping, visiting friends and family, getting […]

The post Not Just Surviving, But Thriving Amidst Covid 19 appeared first on Susan Lager.

If you missed the live podcast, you can listen to it at: www.BlogTalkRadio.com/SusanLager.I’ve shared 16 key attitudes and behaviors for not only surviving, but thriving during this pandemic. I’ll think you’ll find them so helpful that you may want a copy of the printed list! If so, call me at The Couples Center voicemail 603-431-7131, and simply […]

The post Listen to my 6/17/20 BTR podcast “Strategies for Living More Fully Amidst the Covid 19 Pandemic” appeared first on Susan Lager.

Hello Reader, If you’re reading this at the time it’s being written then chances are, you’re grateful to still be healthy if you’re not already sick, you’re missing loved ones you can’t get on a plane to see or grieving someone you’ve lost, you’re sick of Zoom as your main connection to your work and […]

The post Don’t miss my next BlogTalk Radio podcast Wed., 6/17/20 8:30 PM EST: “Strategies for Living More Fully Amidst the Covid 19 Pandemic” appeared first on Susan Lager.

Remember the days when you’d run out of an ingredient you needed for a special recipe and you could just head out to your local supermarket to get it – without fear of death? Remember ambling around with your cart up one aisle and down the next, getting all kinds of things you barely needed […]

The post Life in Coronaland – “Is Cilantro Worth Dying for?” appeared first on Susan Lager.

Here is an excellent CNN Health article which I’m reprinting, because it deals very thoroughly with the potential impact of the Coronavirus pandemic on our mental health. The writer discusses several tools we can all use to offset some of the negative effects of living in lockdown, “hiding from death,” as I think of it.CNN Health: […]

The post CNN Health: “5 Signs Your Coronavirus Anxiety Has Turned Serious, Threatening Your Mental Health, and What to Do About It” appeared first on Susan Lager.

(This CNN article was just forwarded to me by my cousin who is an avid reader, staying afloat in quarantine as a single person through her endless curiosity for information and ideas. I thought the article perfectly captured the dilemmas we all face now in this pandemic, and I couldn’t have covered it any better, […]

The post “If You’re Hitting a Wall You’re Not Alone” appeared first on Susan Lager.

I’m reprinting a brief article I received from the Gottman Institute about how to approach your partner with a complaint without the complaint getting experienced as a criticism, or an attack on their character. This “softened startup” is an approach I’ve been advocating for years to couples, but I thought it was very succinctly captured […]

The post “The Softened Startup” according to the Gottmans appeared first on Susan Lager.

Here is a post I just received and got permission to reprint from Cindy Giovagnoli, a wise old soul, world traveller, photographer, artist and writer. See what you think:Our lives are not “on hold”Oooooh, do I have a doozy of a conversation to have with you today! Not everyone’s going to like this, but I think […]

The post Life Is Not on Hold! appeared first on Susan Lager.

Most everyone in the world, for some time now, has been experiencing the anxiety, losses, uncertainty, and constraints of social distancing related to Coronavirus. We know we’re living in an apocalyptic scenario, we hear all the gory details on the news and from each other every day. The people who seem to be surviving best […]

The post Life in Coronaland appeared first on Susan Lager.

To all current and prospective clients, I hope you and your family are all well and managing this crisis reasonably well. In the interest of safety and social responsibility I’m no longer seeing clients at the office, but instead via either phone or video conferencing through Doxy.me, an easy to use, HIPAA compliant setup. All you’ll need to […]

The post Moving forward with therapy amidst Covid -19 appeared first on Susan Lager.

(Here’s an article my cousin sent me I’m reprinting so all of you can benefit from the honesty and wisdom in it):I have clinical anxiety. If the coronavirus scares you, this might helpI’m not a doctor, but what I’ve come to learn over 20 years is that you really can master your anxiety.By Kara Baskin Globe Correspondent,Updated […]

The post Some insight about managing your anxiety amidst Covid-19 appeared first on Susan Lager.

Most of us like to think that usually things happen to us because we’ve made an overt decision – we enroll in a class, then we take the class, we buy certain foods, then eat them later, we drive in a certain direction and end up at our destination. Our mindset is that when these […]

The post Passive Choices appeared first on Susan Lager.

I’m sharing this beautifully written blogpost with you from Cindy Giovagnoli about expanding our definitions of “productivity.” This is a subject I find personally and professionally very relevant, and one that I think you may too, so I’m delighted that she gave me permission to reprint it here to share with you, my readers.Cindy is […]

The post Rethinking Our Notions About “Productivity” appeared first on Susan Lager.

Most of us have talked about wanting to do or achieve certain things in our lifetime – learn to speak Spanish, remodel the house, write a book of poems, volunteer for a humanitarian cause, take a trip to India, etc. There’s also often a sense of what needs to happen first to make that possible […]

The post Piano Folly – Are You Afflicted With It? appeared first on Susan Lager.

Don’t miss this next BlogTalk Radio podcast!In this 20 minute episode I’ll share my insights about some of the common sources of holiday related anxiety and stress, and how being proactive and intentional can transform the season. If you have a history of some really negative experiences related to the holidays, and struggle with how […]

The post Next 20 Minute BlogTalk Radio Podcast Sunday, 11/24 8:30 PM EST: “Take the Dread Out of the Holidays with Some Simple Strategies” appeared first on Susan Lager.

This guy, Tucker, is one of the 4-legged loves of my life. In previous posts I’ve written about how through our daily romps in the woods around my land and walks around the neighborhood he reminds me about what’s most important in life, especially as I veer off into thoughts about my unanswered emails, […]

The post The Challenge of Staying Present appeared first on Susan Lager.

If you’re a follower of this blog you may have been wondering where I was all summer – why no posts?? Where’s the new material, any new tools or resources, even just thoughts? The answer is: I’ve been having too much fun practicing what I preach to clients: nourishing connection with self, family and friends, mostly outside, nowhere […]

The post I’m Finally Back…. appeared first on Susan Lager.

Are you an “all or nothing,” “black or white” person? If so, you’ve probably created a lot of pressure for yourself with your unacknowledged perfectionism!Tune into my next 15 minute BlogTalk Radio podcast and learn how this attitude and behavior can limit possibilities for connection, conflict resolution, and productivity, among other things.In this brief podcast […]

The post Don’t miss my next 15 minute BTR podcast on Wed. 5/29 at 8:30 PM EDT: “The Pitfalls of ‘All or Nothing’ in Marriage and Life” appeared first on Susan Lager.

Who wants to get up at the crack of dawn, leave a cozy, warm bed, get into a workout outfit and head to the gym for an hour of exertion and sweating? Who wants to spend a Saturday doing the books and paperwork for their self-owned business, instead of listening to music, romping in the woods, or hanging out, eating […]

The post “Being a Grownup When You Must: 6 Practical Tools” BTR Podcast Wed. 4/3 8:30 PM EST appeared first on Susan Lager.

The most prevalent problem I deal with in my work as a psychotherapist with individuals and couples is the issue of how people talk to each other when they’re trying to manage conflict. And “conflict” isn’t always about big ticket items, like how to handle a kid’s bad behavior, or who is spending how much […]

The post How Do You Manage Conflict? appeared first on Susan Lager.

A reminder that my blog has been nominated again to be recognized, now in this competition by StartDating.DK, a Dutch online dating resource. So far, I have 66% of the votes, but not by many votes! If you enjoy this blog, learn some stuff here about how to manage yourself in your relationships, […]

The post Don’t Forget to Vote For Me in the Marriage and Relationships Blogs Awards! appeared first on Susan Lager.

On Wednesday, March 6th at 8:30 PM EST I’ll be airing this 30 minute podcast about a vital issue you and your spouse need to know about – the 4 biggest communication violations around conflict, their dire effect on marriages, and how, with some do-able attitude and behavioral adjustments you can avoid their negative […]

The post Don’t Miss My Next 30 Minute BTR Podcast on 3/6/19 at 8:30 PM EST!: “4 Communication Styles That Can Ruin Your Marriage and How To Fix Them” appeared first on Susan Lager.

Here’s the broadcast about my business, my services and my history. Hope you enjoy it! http://nbrfm.com/showfiles/2018/Susan%20Lager-02%2018%2019-Couples%20Therapy-Chris.mp3

The post Listen to my 2/1819 eight minute interview on National Broadcast Radio here! appeared first on Susan Lager.

Call (603) 431-7131 now to sign up for my coaching and mentoring programs.